All property taxes are billed twice a year. Each billing period is split into two (2) installments.

The due dates are as follows:

|

Bill 1: Interim Property Tax Bill (Residential, Farm, Commercial, Industrial) |

|

|

Bill 2: Final Property Tax Bill Residential, Farm, Commercial, Industrial) |

|

All bills are required to be sent 21 days prior to the payment due date. Bills are sent via Canada Post.

Payment

Here are the different methods of payment we accept:

- Cash

- Cheques

- Post-dated cheques

- Interac

- Pre-Authorized Payment Plan

- Online through your bank

Payments can also be dropped off after hours in the mail slot and must include the tax bill slip. The mail slot is located to the left-hand side of the main door.

You may also pay your tax and water bills at your bank or through online banking. Please note that each bank has a different account name and number format. (Note: tax and water payments need to be setup as separate accounts for each property you own in Laurentian Valley). Please visit our Payment Options page to learn how set up online payment through your bank.

Residents are encouraged to utilize online payment options. Payments can also be delivered to the Township office, dropped in the secure mail slot to left of the municipal office door, or sent by regular mail.

Tax Rates

Duplicate Bills

Duplicate property tax bills, water utility bills, and tax receipts are available for purchase for $10.00 each. They can be purchased online by going to the duplicate bill form.

Mailing Address Change Request

Change in address requests can no longer be received verbally. A 'Change in Mailing Address Form' must now be completed in writing as per the Municipal Act, 2001, Section 343. A request can be made online, or to obtain a paper copy form, please request one via email or call 613-735-6291.

Complete a request online

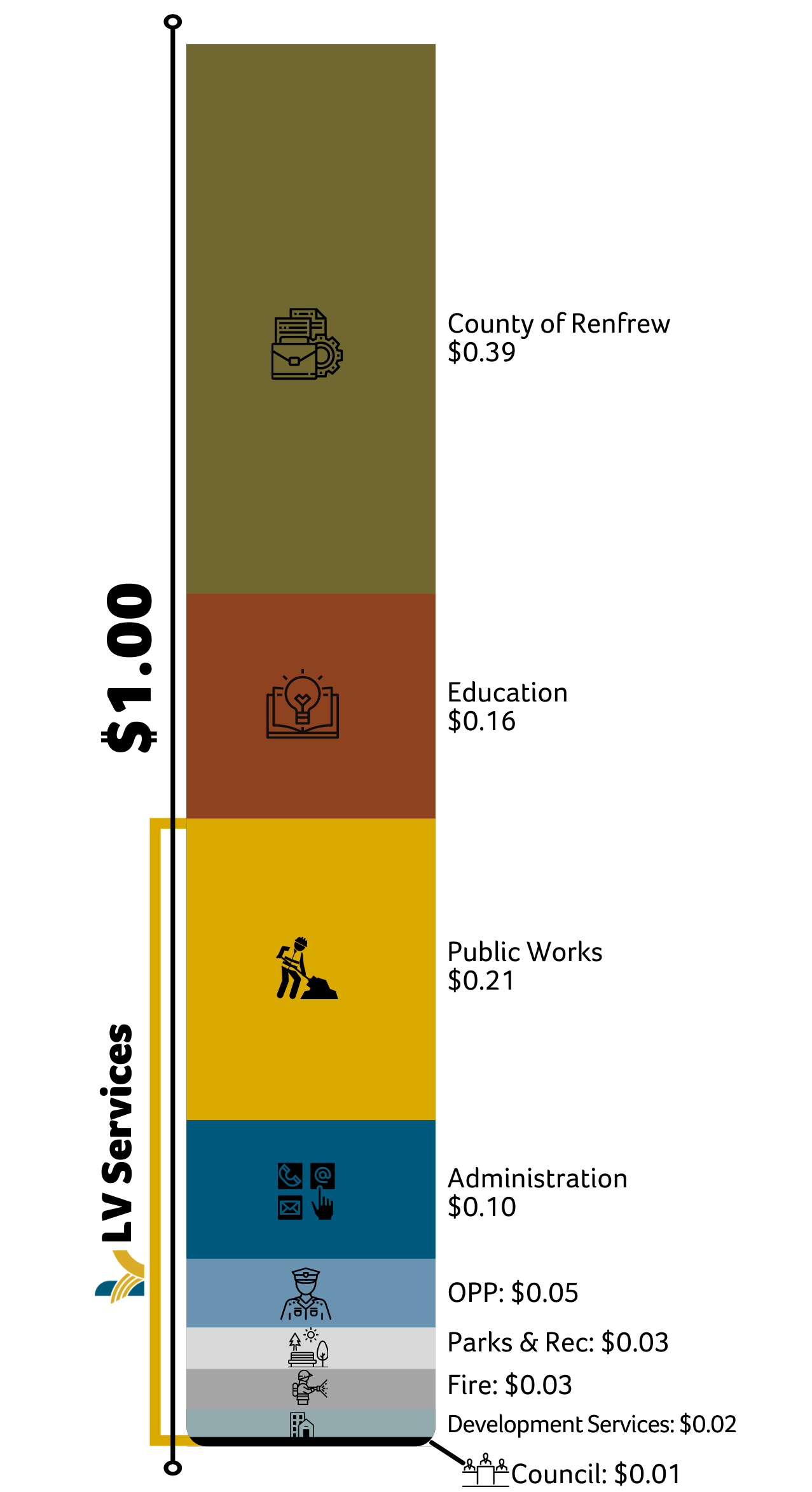

Your tax dollars at work

How do your tax dollars get distributed?

For every dollar ($1.00) you spend, here is the breakdown:

- County of Renfrew = $0.39

- Education = $0.16

- LV Public Works = $0.21

- LV Administration = $0.10

- OPP services = $0.05

- LV Parks & Recreation = $0.03

- LV Fire Department = $0.03

- LV Development Services = $0.02

- LV Council = $0.01

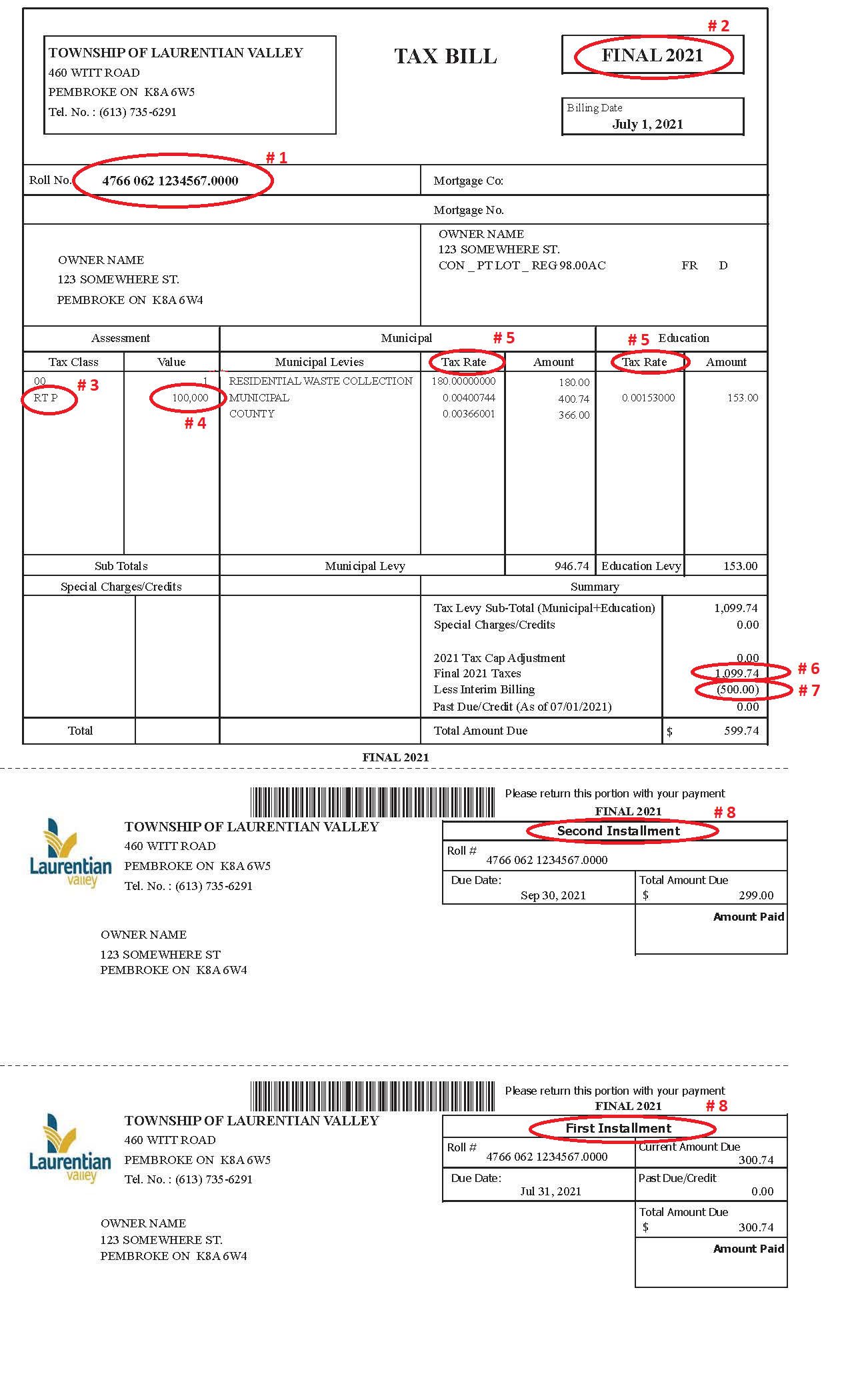

How to read your tax bill

Reference the above sample property tax bill to learn more about each section. Each number below expands to provide an explanation to the corresponding number on the image.

Download a PDF version of the sample bill

|

#1: Roll Number |

|

Located on the upper left-hand side of property tax bills, this is your property identifier and property tax account number. |

|

#2: Billing Cycle |

|

Located in the upper right-hand corner of property tax bills, this states the period of the billing cycle.

|

|

#3: Tax Class |

|

Located below the property owners name and address, this indicates what tax class the property tax is calculated under. Each tax class has a different tax rate associated to it. The common tax classes are:

|

|

#4: Value |

|

Located next to the tax class, this is the assessed value placed on the property by MPAC. |

|

#5: Tax Rate |

|

Located in the mid-right portion of the tax bill, this is what the assessed value is multiplied by to calculate the taxes payable for the year. These rates are specified every year in the annual budget. |

|

#6: Final Taxes |

|

Found only on the final billing cycle tax bill in the lower right-hand corner, this is the total taxes that will be paid for the year and is the amount that is used when you file income tax return. |

|

#7: Less Interim Billing |

|

Found only on the final billing cycle tax bill in the lower right-hand corner, this is the amount that was billed on the interim billing for the year. |

|

#8: Installment |

|

Located at the bottom of the tax bills, these slips breakdown the amount payable into two installments and state when each installment is due. They are removable to be sent in with payments. |

To learn more about how your property is assessed, go to MPAC AboutMyPropertyTM tool.

Property Tax Reliefs and Supports

| Application for Tax Relief for Certain Elderly and Disabled Persons |

| Click Here to View By-Law and Application |

| Municipal Act Application/Appeal – Sickness or Extreme Poverty |

| Click Here to View Application |

| MPAC Request for Reconsideration |

|

Click Here to View Application Click Here for More Information

|

Where urban amenities meet outdoor rural fun.

LV is home to easy comfortable living.

.png)